Social security calculator 2021

Earnings above this level of income are not subject to social security tax. You Can Also Get Basic Benefit Estimates By Calling The Social Security Administration.

Social Security Early Retirement 2022 Know Your Bend Points Physician On Fire Early Retirement Social Security Benefits Social Security

FICA tax rate for 2022 is the same for the year 2021.

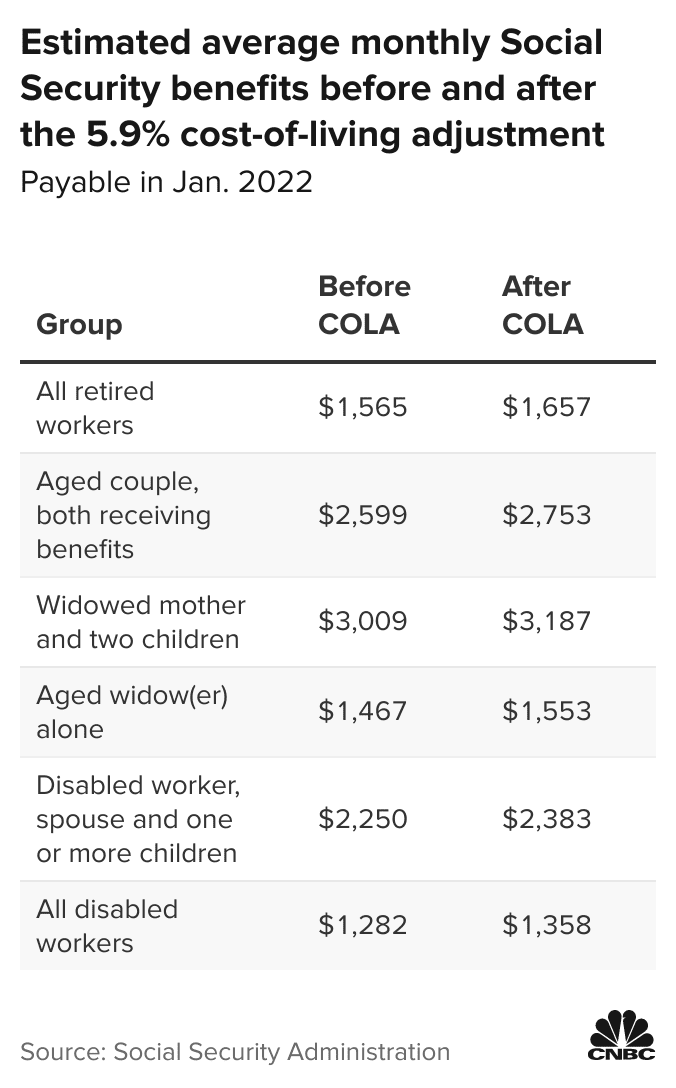

. Social Security taxable benefit calculator Filing Status Single Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding SS. Social Security beneficiaries are slated to receive a 59 increase in 2022 the biggest boost in benefits in 39 years. Taxable Social Security 40500 25000050 40500 34000035 10025 85 of Social Security Benefit 20000 085 17000 Taxable Social Security.

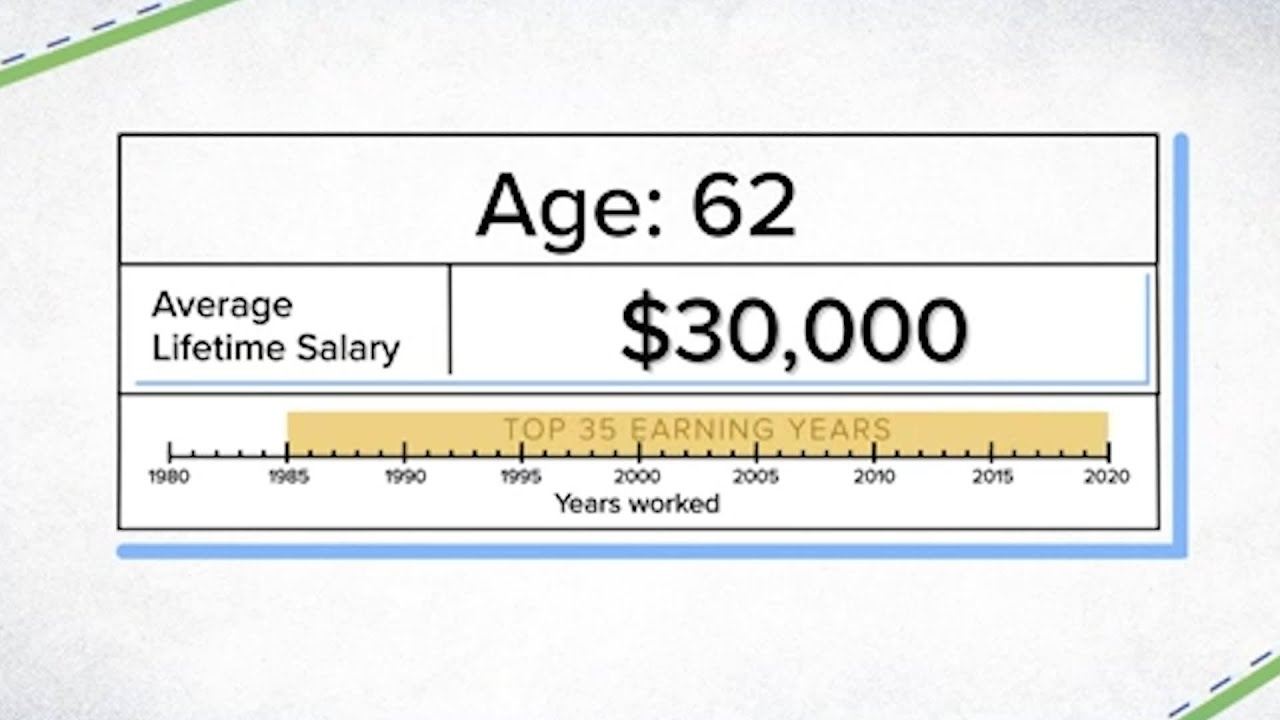

The United States Annual Tax Calculator for 2021 can be used within the content as you see it alternatively you can use the full page view. To use the Online Calculator you need to enter all your earnings from your online Social Security Statement. This calculator estimates Social Security benefits for single people who have never been married for married couples and for divorced individuals whose marriage lasted at.

- Calculator Social Security Calculator Will your social security benefits be taxable. This is handy if you are flicking between different. The 59 percent cost-of-living adjustment COLA will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022.

Advisors to work with you to make sure that your retirement planning is on track. In other words for both 2022 2021 the FICA tax rate is 1530 which is split equally between the employer and employee. Multiply that by 12 to get 50328 in.

A 9 cost-of-living adjustment to Social Security in 2023 would add about 150 to monthly checks on average or an additional 1800 a year. This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a. Social Security Disability Benefits Calculator Earnings from your jobs covered by Social Security meaning your FICA taxes are used to determine the amount of monthly SSDI benefits.

Social Security Contributions Calculator. However up to 85 of benefits can be taxable if either of the following situations applies. Increased payments to approximately 8.

Over your lifetime which filing age will net you the. Ad A Quick Easy Way To Check Is Using AARPs Social Security Benefits Calculator. Please specify your source of income tick all that apply.

For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021. Use this calculator to see. Give you an estimate of how much youll have to pay in taxes on your monthly benefits.

Income and Tax Information Calculating Modified Adjusted Gross Income Social Security Benefits Tax. With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. The provisional income or combined income can be found by Adding Adjusted Gross Income plus Nontaxable interest plus 50 of the social security benefits Then compare.

Ad Heres How the Social Security Retirement Benefit Formula Works. Before you use this. Break Even Calculator - Social Security Intelligence This Social Security break even calculator helps answer the question.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. Ad Retirement Planning Services can help you create a plan tailored to your specific needs. And Munnell said its highly likely.

Future proceeds from Social Security are only loosely based on past income levels. Use our Social Security tax calculator to better calculate your Social Security benefits. How Much Is Taxable.

Thats what this taxable Social Security benefits calculator is designed to do. How to calculate your. The My Social Security Retirement Calculator automatically gives you an estimate of your Social Security benefit if you start payments at age 62 full retirement age and age 70.

The Online Calculator below allows you to estimate your Social Security benefit. The maximum Social Security benefit changes each year. Social Security increase 2021.

For example a person earning 20000 per year would receive approximately 800 per month in benefits. Generally up to 50 of benefits will be taxable. The 2022 limit for joint filers is 32000.

Tax deferred retirement plans tend to increase tax liability on social security.

How To Get The Maximum Social Security Benefit Smartasset

Resource Taxable Social Security Calculator

Pin On Spreadsheets

Social Security Disability Benefits Pay Chart 2022 Evans Disability

What S In Your Purse Baby Shower Game Easy Baby Shower Etsy Simple Baby Shower Whats In Your Purse Easy Baby Shower Games

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

At What Age Is Social Security No Longer Taxed In The Us As Usa

Program Explainer Special Minimum Benefit

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

Social Security Who Is Receiving Checks For Up To 1 657 Today Marca

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

Social Security Recipients Would Receive 200 Extra Each Month With Newly Introduced Expansion Bill Masslive Com

Working While Collecting Social Security Limits And Examples Youtube Social Security Social Financial Decisions

Pin On Retirement